Wall Street Shakes – White House Hits Back at Recession Rumors!

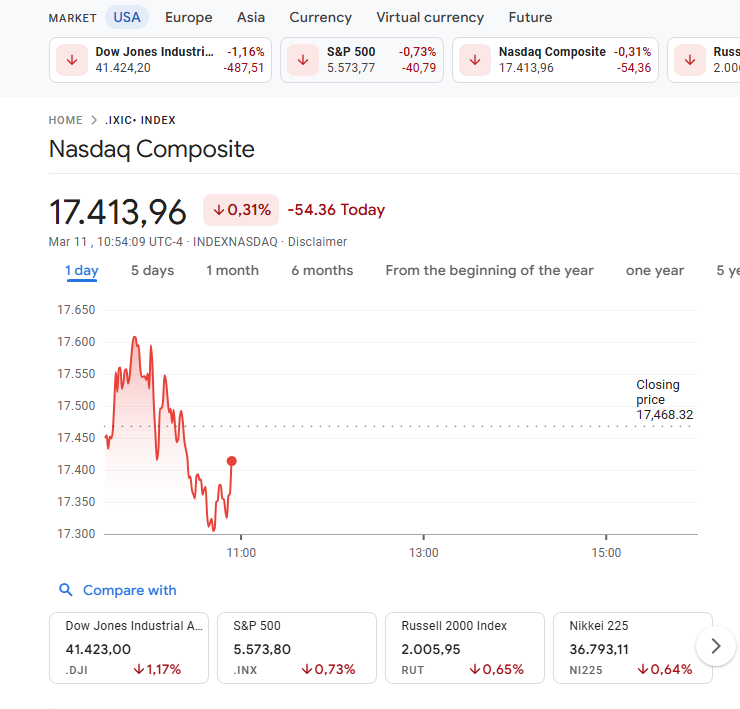

US stocks just had a bad trading session , when both the Nasdaq Composite and the S&P 500 plummeted . Amid growing recession fears, the White House was quick to dismiss negative predictions.

But will the market really stabilize again?

US Stocks in Free Fall – Wall Street Faces Big Risk

The last trading session saw the Nasdaq fall more than 3% , while the S&P 500 lost 2% , marking an 8% decline from its historical peak .

Investors are confused as the Trump administration refuses to predict the impact of its tariff policy on the economy.

Economist Kevin Hassett , a key adviser to the US President, asserted that there are still many reasons for optimism , although GDP may decline and inflation continues to be a major concern.

However, many experts say Trump is in denial about reality and a recession may just be a matter of time.

“Backfire” – Can Tariff Policy Cause Crisis?

Once expected to help the US economy take off, Trump’s tariff policy is now seen as a double-edged sword . Anthony Scaramucci , former White House Communications Director, frankly commented:

“Trump’s tariff policy could drag the US into recession.”

Not only stocks, big tech companies were also hit hard . Tesla (TSLA) shares fell 15.43% , while MicroStrategy (MSTR) plunged 16.68% .

Some experts are more optimistic. Arthur Hayes , former CEO of BitMEX, believes this is just a normal correction of the bull market.

Meanwhile, Thomas Hayes , Director of Great Hill Capital, commented that the impact from Japanese government bond yields is really the factor worth watching.