Is Bitcoin Repeating Its 2017 Cycle? Is Long-Term Holding The Best Strategy?

Bitcoin is following a very similar pattern to 2017 , when it was nine months away from peaking.

If history repeats itself, the “extreme greed” phase could begin in late 2025 , opening up huge growth opportunities. But in times of volatility like the present, is holding Bitcoin a wise strategy?

Several technical indicators suggest that the long-term trend remains positive. Bitcoin’s RSI Bollinger Band % is at extreme lows, similar to what happened in 2013 , 2016, and 2020 – right before BTC set new highs.

In 2017 , Bitcoin dropped below $1,000 before skyrocketing 1,500% , reaching $19,086 by the end of the year.

Currently, Bitcoin is hovering around $83,000 , but there are no clear signs of a solid bottom.

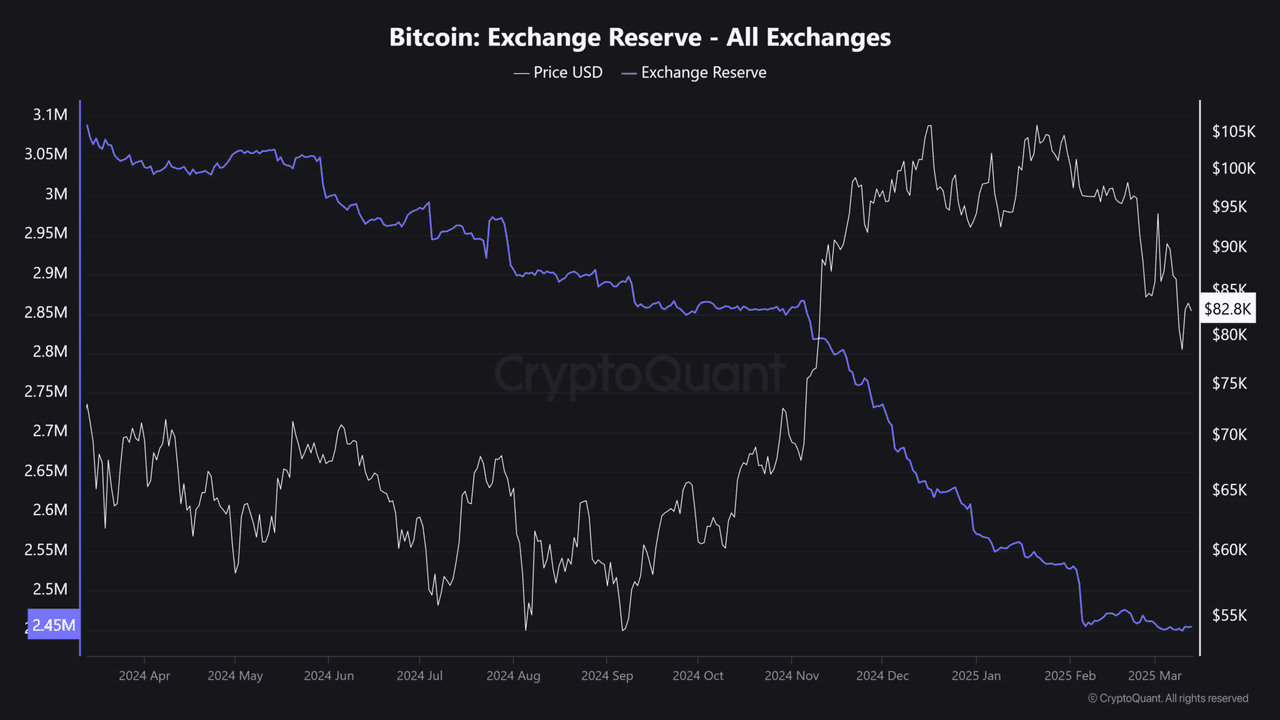

Market data, however, paints a different picture. The amount of Bitcoin on exchanges is falling to its lowest level in a year , suggesting that many investors are still accumulating rather than taking profits.

This also means that there are no signs of a real market top forming . Meanwhile, the amount of Bitcoin held by long-term holders is decreasing, partly due to concerns about the economic situation and the upcoming 2024 US election .

As things stand, if Bitcoin truly mirrors the 2017 cycle , the price peak could be about nine months away.

However, in the short term, Bitcoin must surpass the $90,000 threshold to confirm the uptrend. In the long term, with continued money flowing into the market and investor confidence not waning, Bitcoin could very well enter the six-digit price range .