Justin Sun hints at the possibility of launching an ETF for TRON (TRX). With the expansion of TRX to Solana and the development of the USDD stablecoin, TRX aims for institutional participation and deeper market integration.

Amidst volatile market conditions, TRX focuses on regulatory compliance, cross-chain integration, and stablecoin development to drive cryptocurrency adoption.

Why is the TRON ETF rumor spreading?

Justin Sun hinted at the possibility of launching a TRON ETF , fueling speculation that TRX could enter regulated crypto financial products. This comes amid the approval of Bitcoin and Ethereum spot ETFs, attracting interest from traditional finance.

BlackRock and Fidelity are pushing for new applications, and TRON could follow. While no formal filings have been made, Justin Sun has hinted at institutional interest in TRX. If a TRX ETF materializes, it would be a major step in bringing TRON into the mainstream financial market.

USDD is rising steadily

TRON’s USDD Surpasses $270 Million in Market Cap, Showing Resilience Amid Tighter Regulatory Scrutiny Justin Sun Pledges to Expand USDD to Multiple Blockchains Beyond TRON, Aiming for Real-Life Utility Rather Than Just Speculation

With the growing demand for stable assets, the development of USDD could shape the future of TRX.

TRON Recovery Is Ongoing, But Trading Volume Is Slow

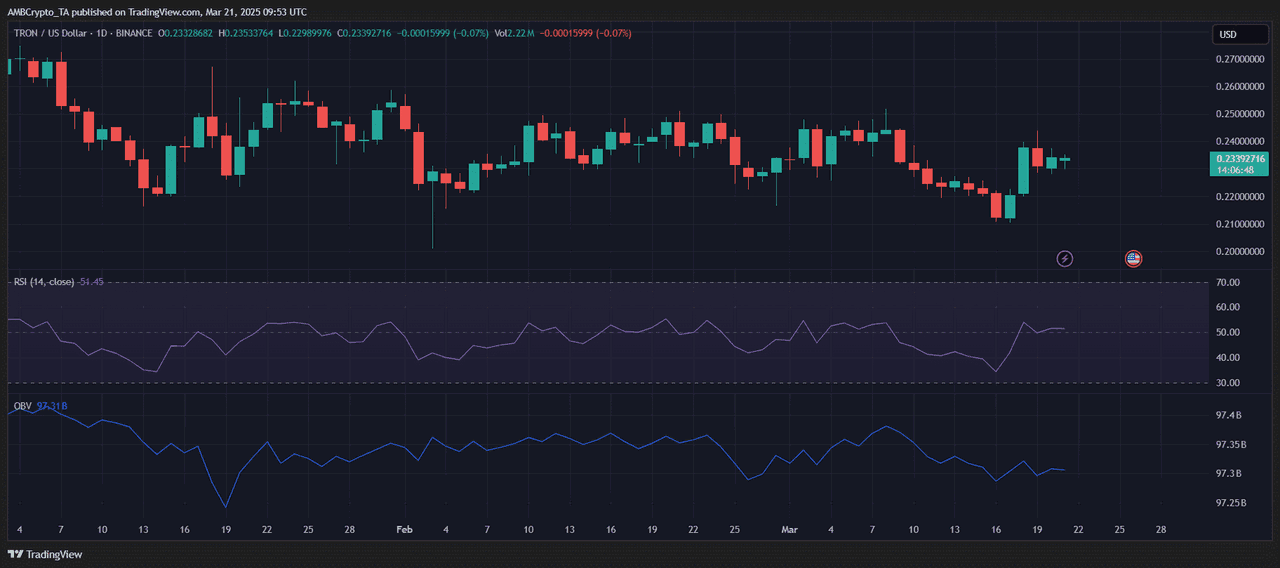

TRX is trading at $0.233, recovering slightly from the decline earlier this month. The RSI is at 54.45, indicating neither overbought nor oversold conditions, suggesting upside potential. The OBV is stable around $97.31 billion, reflecting weak investor sentiment despite signs of recovery.