The cryptocurrency market recorded a severe downturn as investors worried about inflation, Fed policy and US-China trade tensions.

Bitcoin and the entire cryptocurrency market continue to face strong selling pressure as a major correction takes place at the start of the new week.

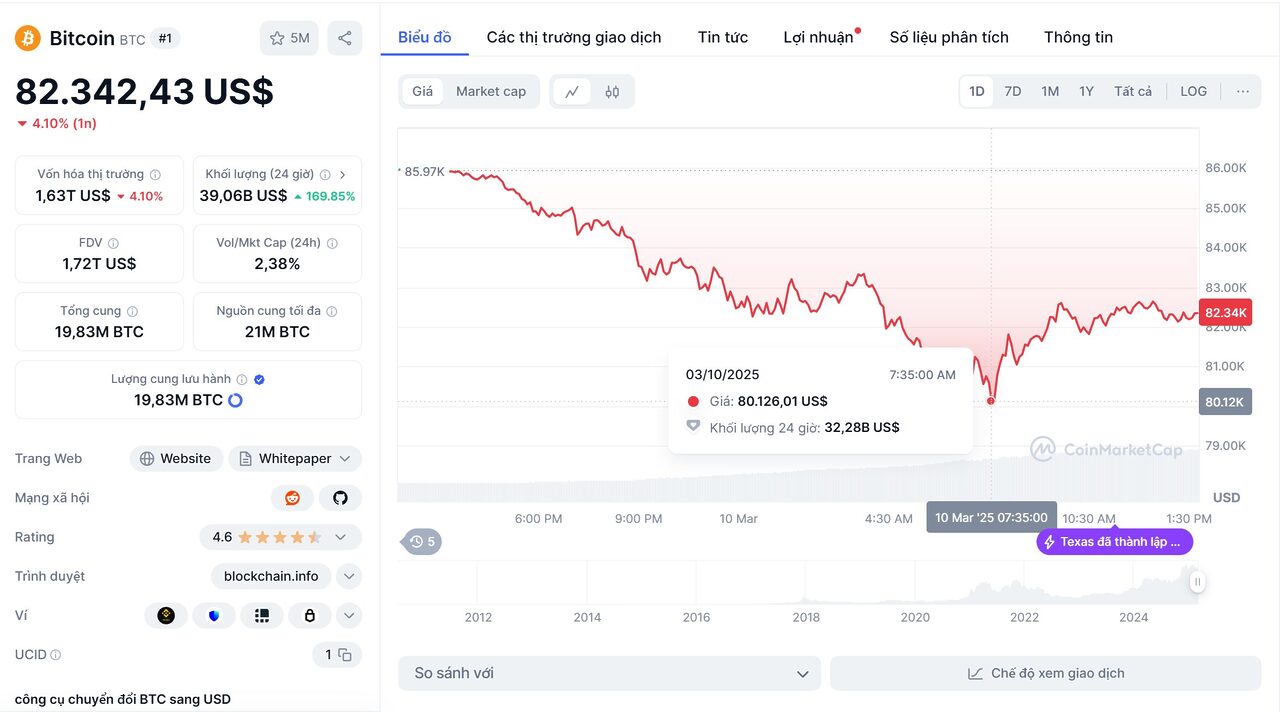

BTC has fallen more than 11% over the past week, nearly erasing its previous gains, and is currently hovering around $82,342, down more than 4% in the past 24 hours. If this trend continues, Bitcoin could retest its 2025 low of around $78,000.

The market is on fire, more than 600 million USD was liquidated

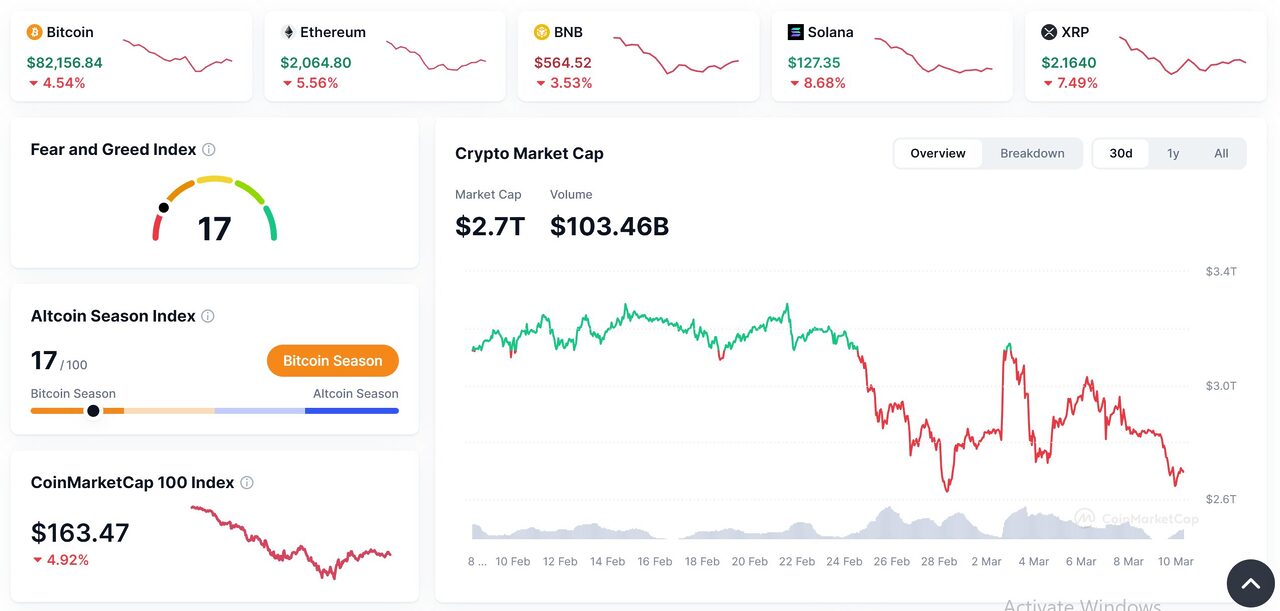

Bitcoin’s weakness was followed by a decline across the entire cryptocurrency market. The total market capitalization fell 7% to $2.77 trillion. Top altcoins were also under heavy pressure:

- Ethereum (ETH) fell more than 5.5%, approaching the low of $2,000.

- Solana (SOL) and XRP lost 8.7% and 7.5% respectively.

- Cardano (ADA) and Dogecoin (DOGE) also saw a sharp decline of around 8%.

Over the past 24 hours, the market has seen over $616 million in liquidations , with $540 million coming from long positions . Bitcoin accounted for the majority of the losses, wiping out $231 million , raising concerns of further downside.

Furthermore, the Fear and Greed Index – which signals an “Extreme Fear” score of 17. However, traders bought into the dip, sending volume soaring more than 94% to $101.31 billion.

Trump warns of economic disruptions

Global economic tensions are also weighing on investor sentiment. In a recent interview with Fox News , US President Donald Trump, when asked about the risk of a recession by 2025, responded cautiously:

I hate to predict things like that, but there may be a transition period. What we’re doing is huge – we’re bringing wealth to America, and that takes time.

Although Commerce Secretary Howard Lutnick has dismissed concerns about a recession, Trump has acknowledged that his economic policies, including tariffs and budget cuts, could cause some short-term disruption.

The comments have drawn comparisons to former Fed Chairman Paul Volcker , who raised interest rates aggressively in the 1980s to control inflation, knowing it would trigger a recession.

US-China trade tensions escalate

The situation is further complicated by the escalating trade tensions between the US and China. Beijing has just announced tariffs on US agricultural products in response to Trump’s new tariff moves. This development could cause major disruptions in global financial markets , increasing investor anxiety.

Separately, Federal Reserve Chairman Jerome Powell said Friday that the Fed will be cautious on interest rates while assessing the impact of Trump’s policies.

This comes shortly after the US non-farm payrolls report showed weakness, raising expectations that the Fed could cut interest rates at least three times this year .

Predictions on the Future of the Cryptocurrency Market

Market experts are closely watching the US Consumer Price Index (CPI) on March 12 and the Producer Price Index (PPI) on March 13. If inflation continues to be high, the Fed may maintain a tight monetary policy, putting Bitcoin and the broader cryptocurrency market under further pressure.

Market reactions are divided into two opposing views:

- Some investors see this as a buying opportunity, expecting the market to recover when Bitcoin rises back above $95,000 .

- Meanwhile, many others are concerned that the downtrend is not over yet, especially as institutional money continues to flow out.

Bitcoin’s recovery will depend on inflation, Fed policy, and cryptocurrency regulations . If these factors turn positive, the market could soon regain momentum. However, in the short term, investors should prepare for a period of high volatility ahead.